Where the Construction Industry is Heading in 2022

index

index

Nonresidential construction is trending upward in 2022, but most of the newly passed $1 trillion infrastructure bill will take significant time and effort to plan and execute. Peter Gregory, senior vice president and national manager at Wells Fargo Equipment Finance, analyzes trends to interpret where the market is going and the underlying reasons our economy is heading for a mild recession in 2023.

Each year brings new challenges in the construction industry, and 2022 is no different. COVID-19 has been with us for more than two years, and the decisions made by governments and businesses in the early stages of the pandemic are still affecting the markets today – and will for some time.

As we talk with companies across the industry, including OEMs, distributors and contractors, we hear from each sector what excites them about the industry as well as what keeps them up at night. Many industry executives are optimistic and expect increased growth in the non-residential space for the remainder of 2022. However, with so much economic uncertainty, there is still a level of caution. Below is a current snapshot of the industry and common themes companies will continue to see through 2022.

The State of the Industry in 2022

The November passage of the $1 trillion infrastructure legislation will provide a generous lift for increased spending in the non-residential business sector in 2022 and beyond. While the legislation lays out the funds for the work, most of it is not “shovel ready” and takes a tremendous amount of time to plan, bid and prepare for the work to begin. Prior to its passage, many states had put together lists of projects with their respective departments of transportation, but did not have the funding to complete much of the needed work; this bill will help with that. The bigger projects, like rail, will take much more time and planning and this work will go out over many years.

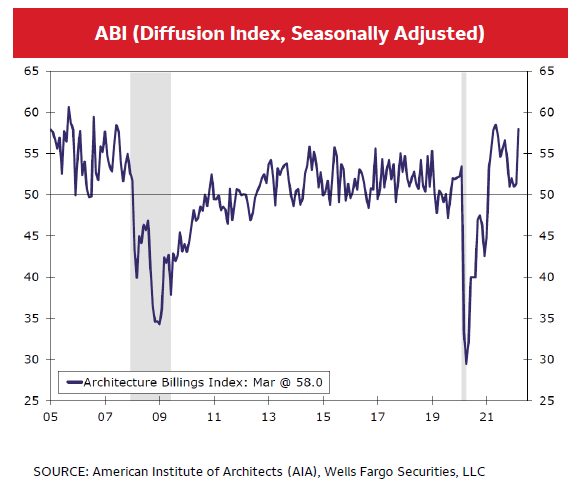

The Architectural Billings Index (ABI), an economic indicator for nonresidential construction activity, has been used in the construction industry for more than 20 years and has a lead time of nine to 12 months. The ABI ended 2021 at 52, which generally means a positive outlet because any reading above 50 indicates growth. At the beginning of 2022, we saw a slight decline at 51, but it bounced back in March and April with improving scores of 58 and 56. There is speculation that these increases may reflect an urgency to beat the continued interest rate hikes coming from the Federal Reserve.

Another industry measure experts use is the Dodge Momentum Index1, a monthly report for nonresidential building projects in planning, which has shown construction spending leading nonresidential buildings by a full year. The Index had a stellar 2021, rising 23% from 2020 and reaching levels not seen in nearly 14 years. The index dropped 7% in January 2022, then rebounded with 4% increases in both February and March, followed by a 6% increase in April. Rising interest rates and the continued increases in material prices may have an effect on possible rising trends throughout the rest of 2022 – this is something to keep an eye on.

According to an analysis of government data completed by the Associated General Contractors of America (AGC), prices of construction materials jumped 20.3% from January 2021 to January 2022. The producer price index for new non-residential construction, which is defined as the prices charged by goods producers and service providers, also increased by 20.8% over the past 12 months. Steel, lumber, cement and copper prices continue to rise in 2022, and many expect it to keep increasing throughout the year due to construction activity and the Russia-Ukraine conflict.

While the effects from COVID-19 have been difficult on businesses, there have been some positive changes. To support the increasing demand of projects, companies are building new warehouses and distribution centers. In addition, more businesses are shifting to e-commerce, leading to the buildout of data centers to provide the appropriate bandwidth for online business activity.

Supply chain issues will continue for a while as many still rely on products from overseas, but this challenge has sparked multiple discussions around increasing U.S.-based production of goods and products.

Rising Interest Rates

The markets have benefited from extremely low interest rates for many years. The monetary policy of the Federal Reserve is now front and center, with most financial institutions expecting four more rate increases in 2022; three have already happened in March, May and June. After the recent June meeting, and the 75-bps increase, the Fed has stated it will utilize every tool at its disposal to bring inflation down to a lower level. In a report to Congress this week, the Fed stated it will launch a full effort to bring down inflationary pressures that are running at their fastest pace in 40 years. A tool the Fed uses, the Dot Plot, shows the median dot, which now stands at 3.375%, indicates the Fed anticipates that an aggregate of 175 bps of additional rate hikes will be appropriate over the four remaining FOMC meetings in 2022.

WF Securities looks for the FOMC to hike rates by an additional 275 bps between now and early 2023. Specifically, it looks for the committee to hike rates by 225 bps by year-end (i.e. 75 bps in July and 50 bps at each meeting in September, November and December). They also look for 50 bps of additional rate increases in early 2023, which would take the top end of the target range for the fed funds rate to 4.50%

The high inflation surge has driven the need for these multiple rate increases. It’s important the Fed monitors rates so inflation does not go too wild, while also not raising rates too quickly, to avoid putting the economy in to a recession. It’s a tricky balance, but very essential. Chairman Powell stated recently he believes the Fed can control the inflation and keep the U.S. out of a recession, though many analysts believe the U.S. is headed for a mild recession in 2023.

Higher interest rates have a huge effect on the construction industry as contractors are capital-intensive companies and can own anywhere from 20 to several hundred pieces of equipment, depending on the company’s size. The cost of a piece of construction equipment can run anywhere from $150,000 to $1 million for larger, more complex units. The overall cost of financing the equipment they need can have a major effect on the company’s profitability. In these circumstances, most will look to pass on the increased costs when bidding future jobs and in other areas of their business.

Distributors often utilize a mix of floating rate lines of credit and fixed rate loans to finance their inventory and rental fleets. These rate increases will make it more expensive for them to run their businesses and they will look to pass on these increased costs in the form of higher rental rates and increased sales prices, which we have seen happen this year.

OEMs often offer subsidy dollars to buy down the interest rates for both their distributors and their contractor clients, this helps to sell their equipment faster and to compete with OEMs that have a captive finance company. With the higher rates, their cost to buy down these interest rates will also increase, and they will need to decide if they want to continue offering the same dollars as before the increase (and be less profitable), or to pay the same amount of subsidy and offer a little higher rate to their customers. It is never an easy decision and competition in the market can have an impact on the decisions.

Supply Chain Disruptions

The supply chain disruptions created by COVID-19 are making it difficult for OEMs to manufacture the equipment their distributors need to sell, and difficult for their distributors to get the equipment their contractor clients want to buy. Recent OEM discussions and guidance states the supply chain challenges, labor issues, chip shortages and rising prices for raw materials, could take nine to 12 months to resolve. This could delay the OEMs’ manufacturing output until late 2022 or early 2023, and they may not meet the current needs of the market. As some health experts are cautioning of another COVID-19 surge, OEMs will also need to decide how fast and how far to increase production, as a slowdown in the future could affect them negatively.

Equipment Availability

Distributors are having to get creative to meet their clients’ needs, such as selling units from their rental fleets that they might not have ever considered, utilizing the benefit of fully depreciating rental fleet equipment under the 2017 tax law changes. However, this could create tax issues at a later date.

In addition to selling equipment from their rental fleets, many distributors are also purchasing equipment from contractors, trading with other dealers, and going to auctions. Most are trying to do whatever it takes to keep their customer base from having to go to a different dealer for their contractor needs.

Many contractors are realizing that with the lack of availability of both new and used construction equipment, they need to re-evaluate current inventory to ensure they have the equipment needed for jobs and to limit costs. We have seen a shift in contractors opting to buy equipment rather than rent it, because their monthly payments are similar, if not lower, than their monthly rental payments. As rates start to increase, the cost to finance equipment will go back to being more expensive than renting, and you will see it shift back.

As we have seen so far in 2022, it has brought both opportunities and challenges to the construction industry. Despite the above, the industry is in the middle of another strong year of growth and is critical to the foundation of our country.

Wells Fargo Equipment Finance produces an annual Construction Industry Forecast dating back 46 years. To download the report in its entirety, you can go here.

About the Author: Peter Gregory is a senior vice president for Wells Fargo Equipment Finance, the equipment finance and leasing affiliate of Wells Fargo Bank. Based in Atlanta, Georgia, he is the national manager for the construction manufacturer and dealer services group. His team provides manufacturers and their distributors loan and lease solutions for their inventory and rental fleet equipment financing needs in the U.S. Gregory has held various positions in his 33-year career in the construction-equipment finance field. Prior to Wells Fargo, he served in increasing senior leadership roles at CitiCapital Commercial and GE Capital Solutions.

Professional Recruiter Associates