LinkedIn data show hiring on mend

1620321821753

1620321821753

https://economicgraph.linkedin.com/resources/linkedin-workforce-report-may-2021

Over 176 million workers in the U.S. have LinkedIn profiles; over 97,000 companies in the U.S. use LinkedIn to recruit and members can add over 38,000 skills to their profiles to showcase their professional brands. That gives us unique and valuable insight into U.S. workforce trends.

This LinkedIn Workforce Report is a monthly report on employment trends in the U.S. workforce. It’s divided into two sections: a National section that provides insights into hiring and migration trends across the country, and a City section that provides insights into localized employment trends in 20 of the largest U.S. metro areas: Atlanta, Austin, Boston, Chicago, Cleveland-Akron, Dallas-Ft. Worth, Denver, Detroit, Houston, Los Angeles, Miami-Ft. Lauderdale, Minneapolis-St. Paul, Nashville, New York City, Philadelphia, Phoenix, San Francisco Bay Area, Seattle, St. Louis, and Washington, D.C.

Our vision is to create economic opportunity for every member of the global workforce. Whether you’re a worker, an employer, a new grad, or a policymaker, we hope you’ll use these insights to better understand and navigate the dynamics of today’s economy.

Key Insights

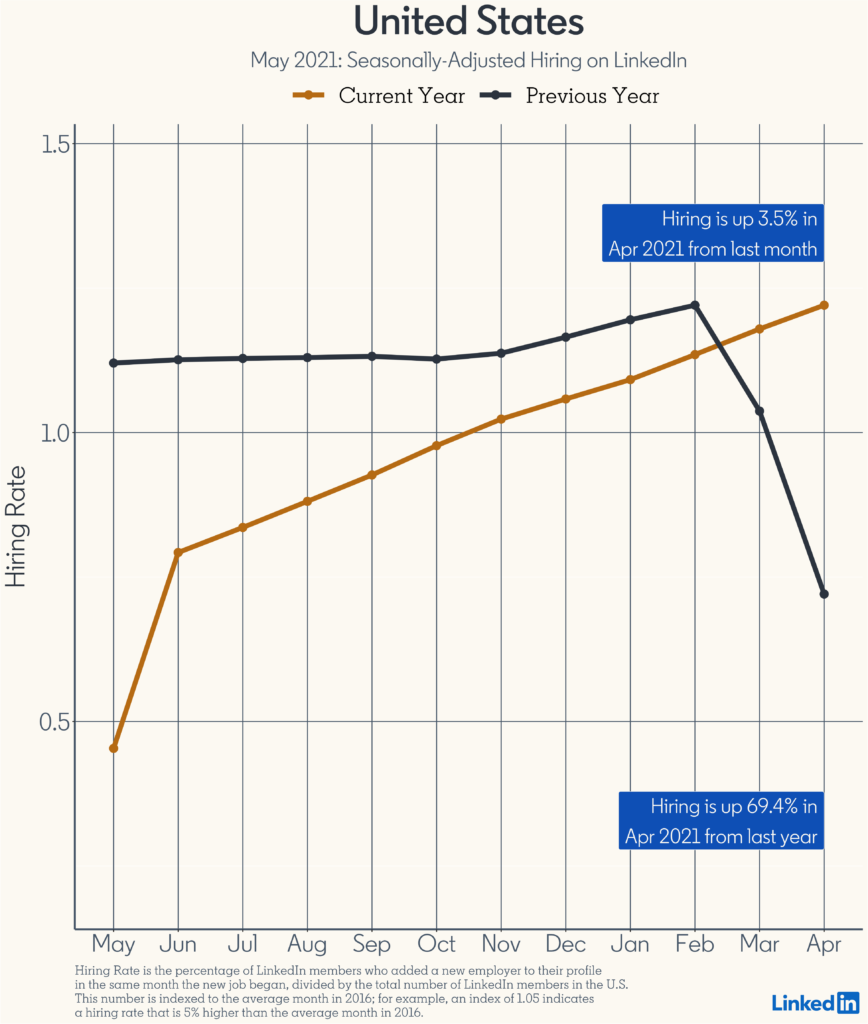

- Nationally, across all industries, U.S. hiring continued its gradual recovery and increased 3.5% higher in April 2021 compared to last month March 2021, reaching pre-COVID highs experienced in February 2020. National hiring was 69.4% higher in April 2021 compared to last year April 2020 and these large year-over-year increases are expected as the anniversaries of hiring drops at the beginning of pandemic are reached.

- The industries with the most notable hiring shifts month-to-month in April were Recreation & Travel (10.3% higher); Entertainment (5.2% higher); and Software & IT Services (3.9% higher). Recreation & Travel and Entertainment in particular were industries hit hard by the pandemic as in-person services were limited. With these large increases, thirteen industries are now hiring at or above their pre-COVID level.

- Twelve metro areas out of the 20 we track are now hiring at or above their pre-COVID level. The metros with the most notable hiring shifts month-to-month in April were New York City (5.8% higher); Boston (4.8% higher), and St. Louis (0.9% higher)

Hiring

The LinkedIn hiring rate is a measure of hires divided by LinkedIn membership. Nationally, across all industries, hiring in the U.S. was 3.5% higher in April compared to last month March 2021. National hiring was 69.4% higher in April compared to last year April 2020.

The industries with the most notable hiring shifts month-to-month in April were Recreation & Travel (10.3% higher); Entertainment (5.2% higher); and Software & IT Services (3.9% higher).

Table 1: Hiring on LinkedIn, by Industry, through April 2021

| Industry | Apr-20 | ··· | Jan-21 | Feb-21 | Mar-21 | Apr-21 | MoM% Change | YoY% Change |

| Agriculture | 0.94 | ··· | 1.12 | 1.19 | 1.32 | 1.22 | -7.5 | +30.8 |

| Arts | 0.31 | ··· | 0.62 | 0.68 | 0.69 | 0.67 | -2.7 | +112.2 |

| Construction | 0.53 | ··· | 0.98 | 1.11 | 1.24 | 1.11 | -10.4 | +110.4 |

| Consumer Goods | 0.44 | ··· | 0.97 | 1.00 | 1.04 | 1.02 | -1.5 | +131 |

| Corporate Services | 0.59 | ··· | 1.07 | 1.15 | 1.29 | 1.22 | -5.6 | +107.9 |

| Design | 0.40 | ··· | 0.82 | 0.87 | 0.93 | 0.92 | -0.2 | +129.3 |

| Education | 0.71 | ··· | 1.04 | 1.12 | 1.17 | 1.21 | +3.2 | +70.5 |

| Energy & Mining | 0.59 | ··· | 0.86 | 0.89 | 0.98 | 0.89 | -8.9 | +49.8 |

| Entertainment | 0.44 | ··· | 0.80 | 0.87 | 0.93 | 0.98 | +5.2 | +121.1 |

| Finance | 0.74 | ··· | 1.13 | 1.17 | 1.28 | 1.24 | -3.5 | +66.8 |

| Hardware & Networking | 0.54 | ··· | 0.79 | 0.87 | 0.96 | 0.90 | -6.9 | +64.9 |

| Health Care | 0.83 | ··· | 1.17 | 1.18 | 1.30 | 1.27 | -2.1 | +54.5 |

| Legal | 0.47 | ··· | 0.99 | 1.00 | 1.07 | 1.03 | -3.5 | +121 |

| Manufacturing | 0.64 | ··· | 0.98 | 1.07 | 1.16 | 1.20 | +2.9 | +87.6 |

| Media & Communications | 0.48 | ··· | 0.87 | 0.98 | 1.08 | 1.08 | -0.3 | +126.2 |

| Nonprofit | 0.77 | ··· | 0.99 | 1.05 | 1.10 | 1.11 | +1 | +44.2 |

| Public Administration | 0.76 | ··· | 1.03 | 1.09 | 1.16 | 1.11 | -4.3 | +46.7 |

| Public Safety | 0.75 | ··· | 0.99 | 1.05 | 1.11 | 1.05 | -5.6 | +39.9 |

| Real Estate | 0.58 | ··· | 1.25 | 1.27 | 1.29 | 1.29 | -0.2 | +123.1 |

| Recreation & Travel | 0.66 | ··· | 0.75 | 0.84 | 0.90 | 0.99 | +10.3 | +51.2 |

| Retail | 0.55 | ··· | 0.94 | 1.00 | 1.09 | 1.01 | -7.7 | +83.4 |

| Software & IT Services | 0.83 | ··· | 1.22 | 1.28 | 1.34 | 1.39 | +3.9 | +67.2 |

| Transportation & Logistics | 0.67 | ··· | 1.13 | 1.18 | 1.33 | 1.30 | -2.5 | +95 |

| Wellness & Fitness | 0.77 | ··· | 1.11 | 1.19 | 1.34 | 1.30 | -2.9 | +69.5 |

Methodology: “Hiring Rate” is the count of hires (LinkedIn members in each industry who added a new employer to their profile in the same month the new job began), divided by the total number of LinkedIn members in the U.S. By only analyzing the timeliest data, we can make accurate month-to-month comparisons and account for any potential lags in members updating their profiles. This number is indexed to the average month in 2016 for each industry; for example, an index of 1.05 indicates a hiring rate that is 5% higher than the average month in 2016.

Migration

Methodology: “Hiring Rate” is the count of hires (LinkedIn members in each industry who added a new employer to their profile in the same month the new job began), divided by the total number of LinkedIn members in the U.S. By only analyzing the timeliest data, we can make accurate month-to-month comparisons and account for any potential lags in members updating their profiles. This number is indexed to the average month in 2016 for each industry; for example, an index of 1.05 indicates a hiring rate that is 5% higher than the average month in 2016.

Migration

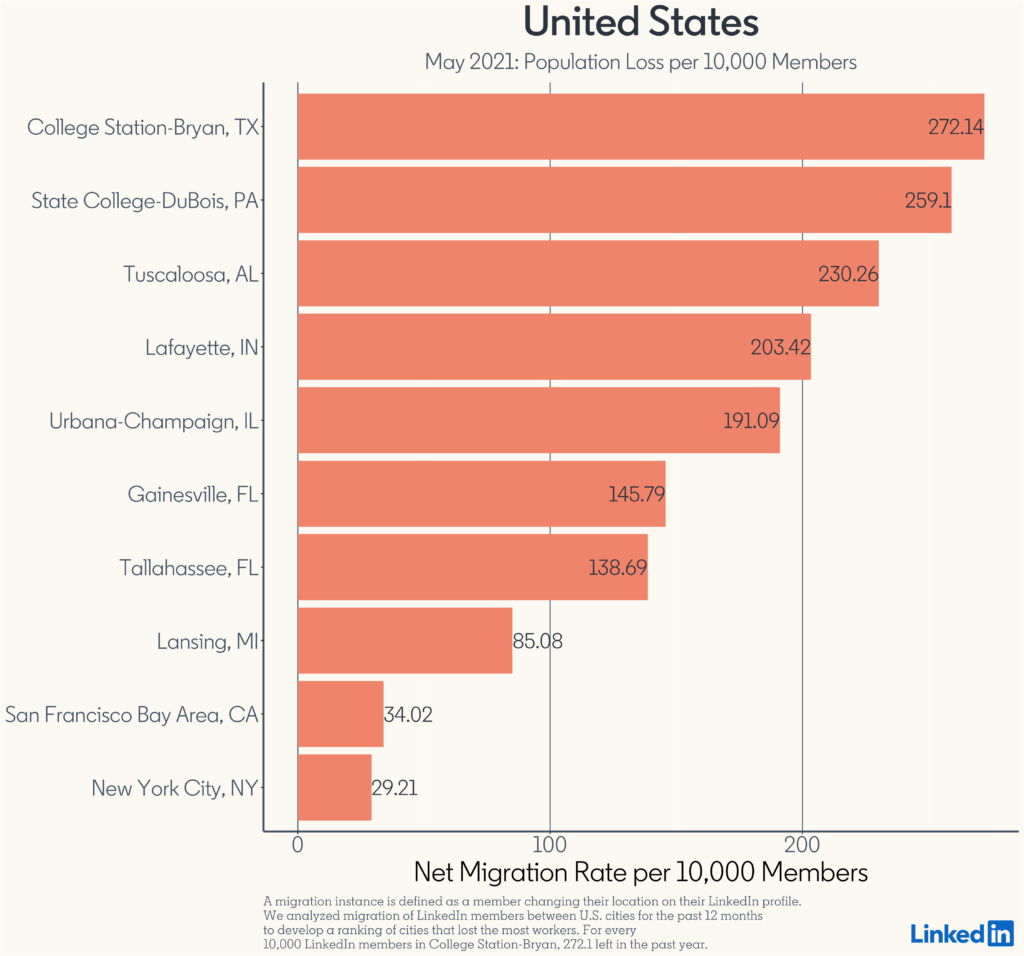

The U.S. cities losing the most people are College Station-Bryan, TX; State College-DuBois, PA; and Tuscaloosa, AL. For every 10,000 LinkedIn members in College Station-Bryan, TX, 272 left in the past 12 months.

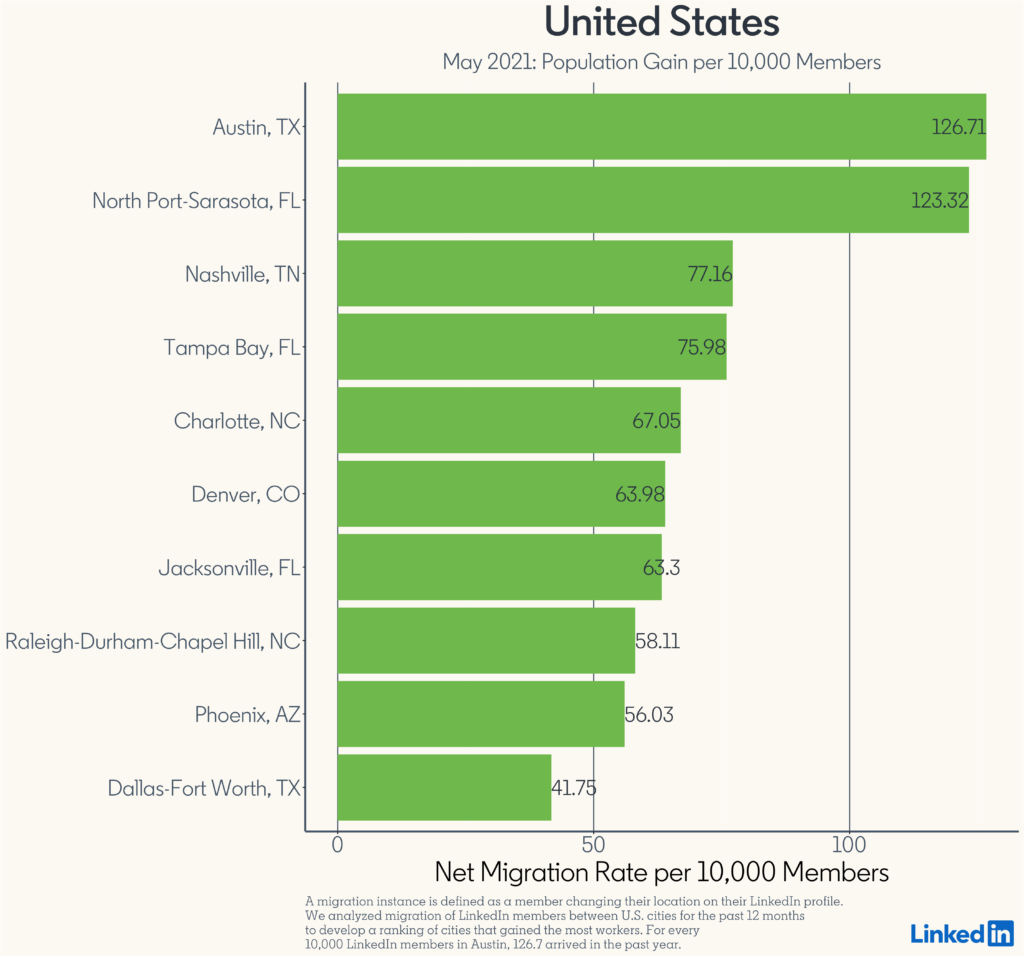

The U.S. cities gaining the most people are Austin, TX; North Port-Sarasota, FL; and Nashville, TN. For every 10,000 LinkedIn members in Austin, TX, 127 arrived in the last 12 months.

Check out our reports for Atlanta, Austin, Boston, Chicago, Cleveland-Akron, Dallas-Ft. Worth, Denver, Detroit, Houston, Los Angeles, Miami-Ft. Lauderdale, Minneapolis-St. Paul, Nashville, New York City, Philadelphia, Phoenix, San Francisco Bay Area, Seattle, St. Louis, and Washington, D.C., to see which jobs are open.

Professional Recruiter Associates